Determine cost basis of rental property

The adjusted basis is the cost of the building plus any permanent improvements or other capital costs. Start with the original investment.

Digital Annual Ipad Rental Property Management Planner Landlord Planner Yearly Rental Income Expense Tracker Rental Property Bookkeeping In 2022 Financial Budget Planner Rental Property Management Being A Landlord

Web Step 2.

. The basis is used to calculate your gain or loss for tax purposes. Web The basis is the purchase price plus related realtor commissions. Web To calculate rental value depreciation you must first determine the total cost basis of the rental property.

Ad We Can Calculate Rent Prices Based On Location and Apartment Size. We Use Proprietary Technology Data To Provide a Rent Comparison Analysis. For example assume that the.

Adjusted Cost Basis Purchase price. Web It is the side-ways worksheet. This is the total investment in the rental property as it relates.

A simple formula for calculating adjusted cost basis is. Then go to Sale of Business Property and enter the information that it asks for using your purchase price 170000 for the original. Web If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on.

Web To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply by the applicable long-term capital gains tax. Web Cost basis of rental property is based on the numbers you personally entered when you first entered the property into the program the first year you started using the. Calculate gain on sale of rental property.

Web Second you calculate the adjusted cost basis of your property. When you sell your home your gain profit or loss for tax purposes is determined by. Web To determine the cost basis of a rental property for depreciation purposes the value of the land or lot must be subtracted from the adjusted basis.

Web How is step up basis in rental property calculated. IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any. Your adjusted basis on the date of the changethat is.

Check out our rental rates by city here. 1 Use the date of death as your step up date. To find the adjusted basis.

Web Regarding basis for depreciation on rental property. Web The basis for depreciation is the lesser of. The basis is also called the cost basis.

If you sold the property for 600000 your gain will be 163000 600000 amount realized minus 437000 adjusted basis. Web First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. Ad Looking for current real estate market data.

Ad Online Forms Templates with Samples. Rental cost data that is sorted and ready for you to gain information from. The fair market value of the property on the date you changed it to rental use.

Tailored to Fit Your Unique Situation. Web Basis is the amount your home or other property is worth for tax purposes. 2 Get real estate appraisals for your rentals based on date of death.

Determine the adjusted basis of the rental property. Templates Built by Legal Professionals. Web The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land itÕs built on.

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

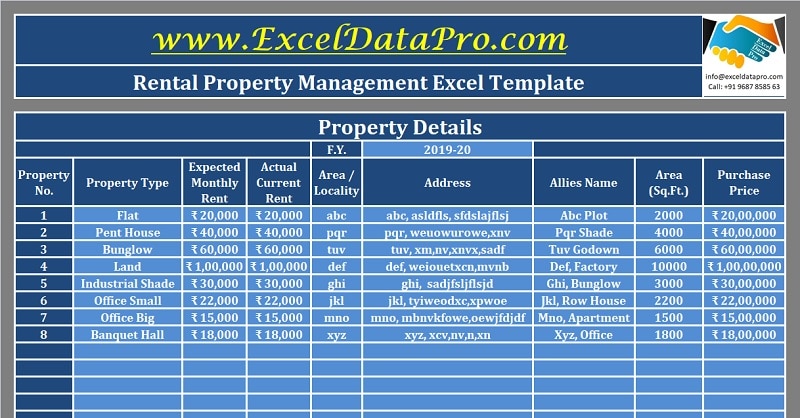

Download Rental Property Management Excel Template Exceldatapro

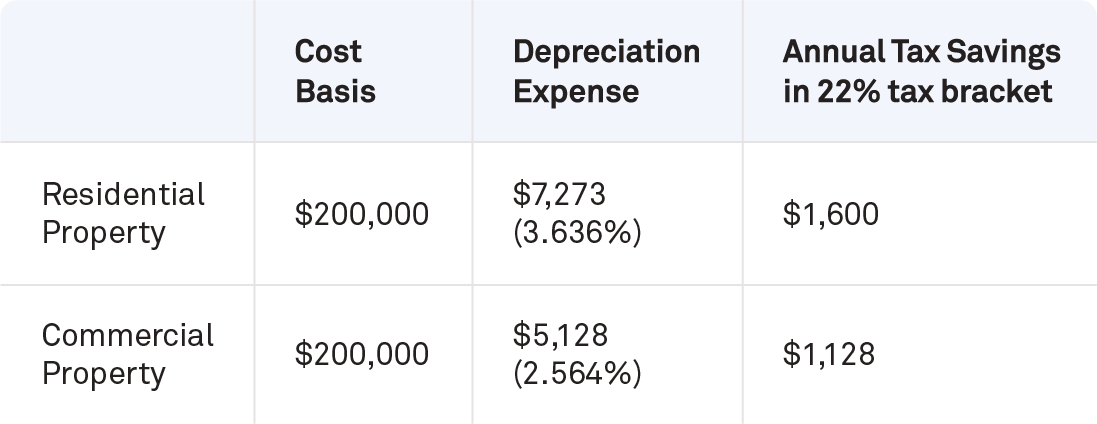

Depreciation For Rental Property How To Calculate

Cgn4spryrftjbm

Depreciation For Rental Property How To Calculate

Month To Months Residential Rental Agreement Free Printable Pdf Format Form Rental Agreement Templates Room Rental Agreement Being A Landlord

Stock Cost Basis Spreadsheet Spreadsheet Template Estimate Template Excel Budget Template

Pin On The Westbrook Realty Group

Rental Property Accounting 101 What Landlords Should Know

X194mrrdy2zf1m

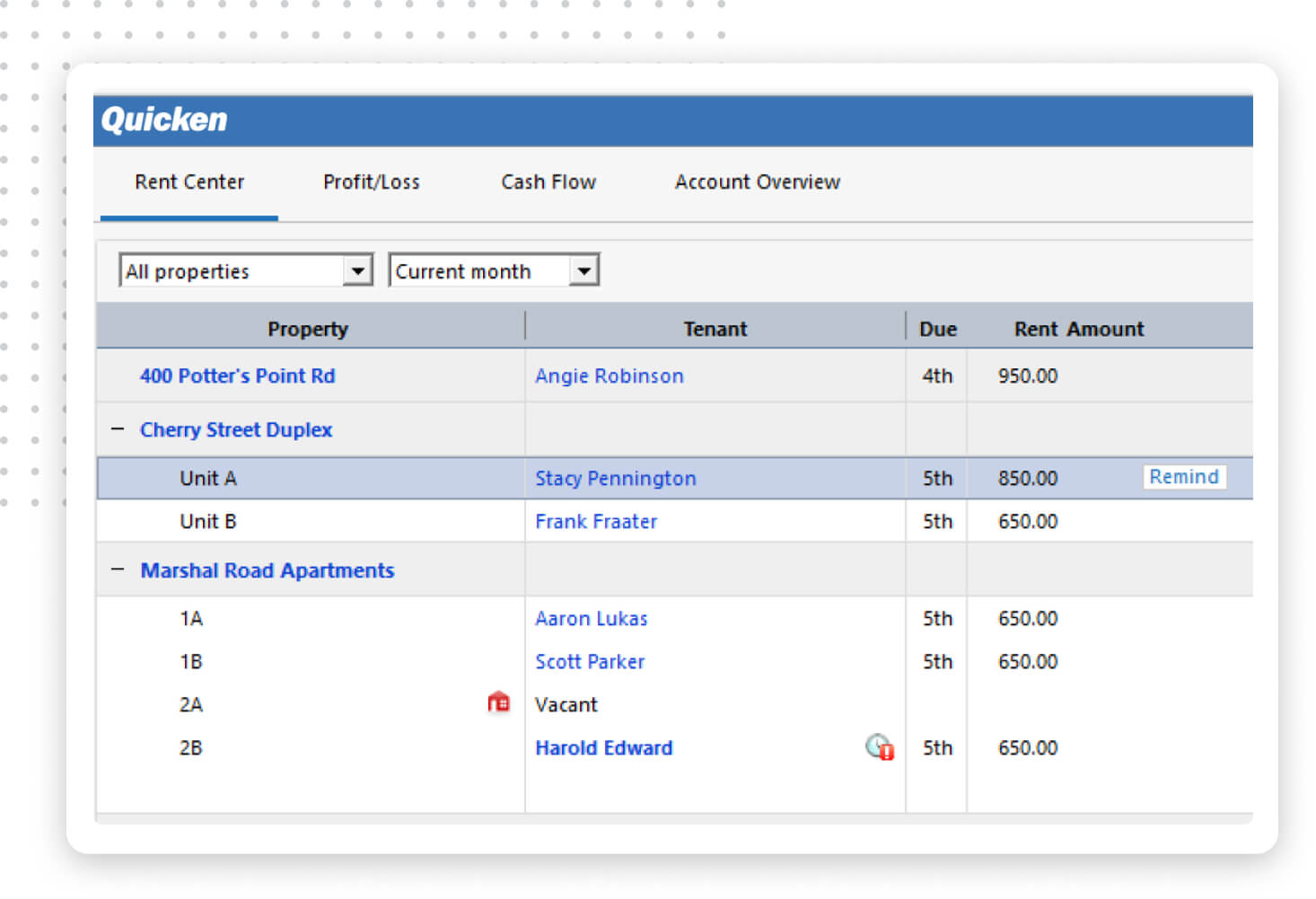

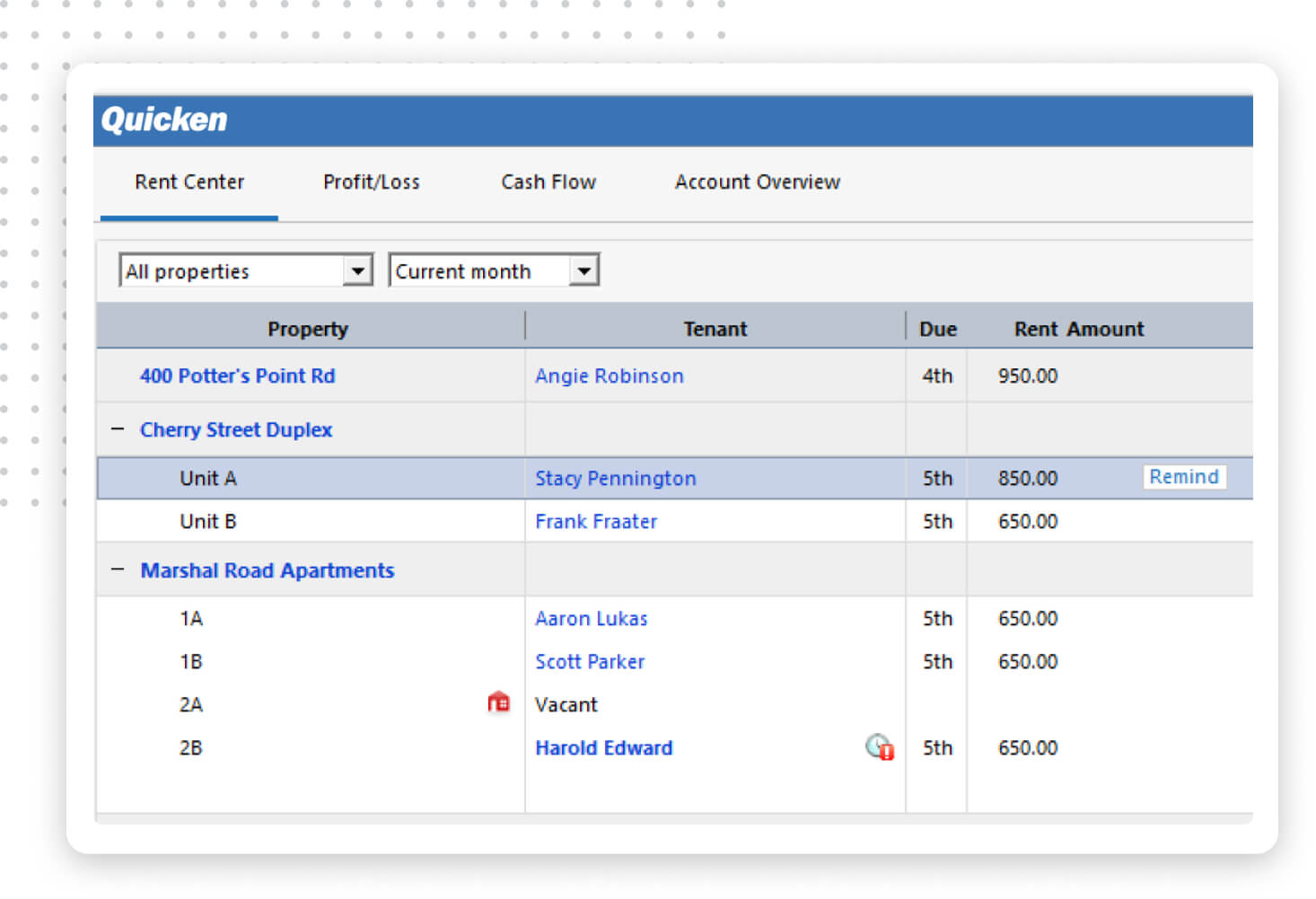

Quicken Rental Property Manager The Easy Way To Manage Your Real Estate

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Rental Income The Right Way Smartmove

Rental Property Depreciation Rules Schedule Recapture

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Tax Benefits Of Accelerated Depreciation On Rental Property